I am sitting in my office and looking around, I see most of my colleagues instead of being heads-down with work, are spending bulk of their day talking with their colleagues on Microsoft teams, our official communication app. They are interacting with people, who are "working from home". On the other side are people who are "working" but cannot make the physical presence in the office to do that. The conversations take hours, what should ideally be few minutes in-person. It is probably, an over-the-shoulder comment, followed by quick couple of questions & answers. The whole office looks like a BPO call-center. Coding is waiting for the calls, and calls are waiting for the coding to happen. Instead of people running ahead with full speed, they are grinding their way out slowly with high-level of operation lethargy. It makes me painful, this way of software development has become the new normal.

Someone told me a long time ago a big truth, that there is absolutely nothing called over-communication in software development. People need to be engaged constantly through the entire implementation phase. Ideas, code details, expectations, requirements, validations, user experience are constantly reinforced amongst the team members, so that the entire team is guided as they make progress. It's like giving a haircut, the team has to be at least in the vicinity. I have seen Projects succeed because that one-person successfully articulated the requirements and got the best out of the team by being with it all the time. This is what works. Now with some people working from office and some working from home, this communication coexistence is clearly broken leading to dilution in the software development models causing unwanted delays and additional stress on team members.

Working from home option existed prior to the pandemic as well. Occasionally you hear people, who says they are working from home, particular days of the week or few on all days. It used to be the resources who work from home on most of the days, are way smarter than the rest and provide an unique expertise to the team. They usually grow into that position. Their credibility is unquestionable within the team. They are always available. Bottom line - they sit at home and work lot harder & smarter, literally more than what they would have achieved if they came in to office every day. More importantly - they are available to come into office on short trips. They would fly in or commute to stay in an hotel for a day or two, they have really jam packed productive meetings, bunch of action items to all, have a game plan to execute in weeks and they go back home "to work" with lot of work in their plate. The visits cost the firm lot of money, but it would be worth it. While working my way as developer, I have seen how these people work. They are very industry experienced, usually super smart and are a pleasure to work. They gain respect of the team, even though they are not with the team. One quality they possess - they don't take leaves. They are available online 24x7. You need to be somebody disciplined and dedicated to be offering your service without leaving your home.

Then came the pandemic.

Once the lockdowns were mandated, everyone were forced to stay indoors. While employees of business who cannot execute their labor remotely, lost their jobs., people in the IT industry were lucky enough to hold on to their job, because they can contribute their labor with no difference sitting at home, what would they have did if they were in office. That was the expectations from the management. That is where it started. The assumption was every employee would sincerely execute his service. May be it was OK to work remotely for a month or two because of compulsions. But definitely it didn’t serve the original purpose and days went by. Employees resisted coming to work - citing genuine covid scare initially. It later turns out to be to avoid relocating to work place, avoid daily commute and more importantly in this part of the world - to save on the expenses. These additional savings in India created a demand for new cars, luxury vacations - those they wouldn't commit to, if they had to expense on the office visit daily. They save on the lunch cost, commute cost overall. Some of them have moved permanently to their native, so that they can save on the rent in the bigger cities. Even though these are good things for the individuals, it not a good deal for the employer (and eventually clients) as more number of people choose to be in their comfort zone rather than try to bring energy to work every single day. Employees with no or little experience were also sitting at home trying to work remotely. First-of-all they don't even have basic skills to work by themselves. The learning curve just got a lot longer. In IT, the start of your career is very important. You need to be in a dynamic, lively, hard-working, interesting work place. That is where you learn a lot. Having a bad start prolongs your learning curve by months. I see lot of them going through that. If you are working in your first job and have never been to an office - it shows up in the quality of the work.

Workplace became workhours. Workhours became beacon of boredom. No new ideas, just grinding the existing stuffs. The only reason the employer could afford this change of behavior, was the client was willing to pay. Finally when the clients run out of money themselves or patience in the team not doing anything creative anymore, they opt to reduce the number of people on the team or shelve new thoughts as there is nothing that is value promising.

I remember, in one of my product development jobs, I would walk-in to office and spend long hours working late with few dedicated team members. My manager would always ask if he needs to order lunch, dinner for us. We always ordered food to be delivered and ate a different cuisine every time, like Chinese, Italian, Thai. Only after a long time, did I realize is the food was being ordered because my manager wants us all to keep rushing the work and doesn't want us go out for lunch which takes an hour at least. Instead, when food is delivered in office, we just walk in to the cafeteria and have a lunch/dinner in 15 mins and back to the desk for work. That were those days, where we were truly productive as a team. We stayed together every day at work. When there is an urgent deliverable and lot of things to accomplish within a limited time-constrain, it makes sense to avoid the commute time and keep your heads down working long hours sitting at home. But when there is not enough to do for 8 hours for employees, laziness creeps in. They tend to avoid difficult & challenging tasks and get used to giving the regular tasks, which they assume can only be done by them. They go into a fully "manage your job" mode. Their tone in chat/voice calls changes because they need to pretend more than what they are actually doing. They need to show-off little bit to justify their contribution. In the process, they shame themselves more. It causes friction within the team members and a lot of moral hazards.

Once they realize they can "manage their pay-check" in their job, people start moonlighting. What used to done in weekends earlier, start to creep in into the weekdays, causing distractions at work. The more and more, they get distracted, the more and more they "manage their jobs". Once their attention on weekdays shifts completely to moonlighting tasks and not their full time jobs anymore, they are fully unmotivated. They navigate to a state, now often referred to as quite quitting. When in this state, they don't treat the job as an obligation. They already gave up on it. They don't want to do more than what they are actually doing now. They are OK, if the employer wants to cut them off. They already have other plans.

Let's be frank. Except a very few, most IT workers in India, do not have enough infrastructure at home like what they have at office. That is why we have these huge glassy buildings with air-conditioning that cost lot of money to rent. It's a luxury for most people. They aspire to have jobs in these fine buildings. Most of working population outside the IT fields, have far less convenient work place. A lot of them don't even have an air-conditioned office space. In spite of all these, employees don't want to work from office. Lot of them don't have proper office desks and chairs similar to what they would find in a software office that will put them in a comfortable posture to sit and work long hours. On top of that, half of them don't even have enough skills to operate individually and contribute. What has software become now with most people still working remotely - they just manage. It's nature of work is just "housekeeping" tasks. They do stuff that they always did for years. They don't have to work for 8 hours a day to accomplish what is expected by their manager. They have worked on the project for really long time, they know enough to make a difference daily. This I call - Keeping the lights on, kind of work. Available for work remotely means different things for different people. Able to fix few critical things over a week is one, being available to answer project related questions is another, taking a 15 minute phone call with client late in the night is one-kind, rudely managing few juniors on the phone calls and getting things done is one kind, delegating all work to someone else in the team relaxing yourself, is also another kind, In all these activities, a lot of hot potatoes happen. Things are thrown to others, and holding on to bare minimum tasks for self. One real problem with this "managing" by most employees - you run of money, sympathy & patience from the person who is funding this activity.

There is a bad behavior by few people and then there is a mob behavior modeling around the few, by the rest of them. Eventually everyone gets to "know the game" and start playing around their personal agenda.

Somewhere during the last decade, for some weird reason, employees became more authoritative than employers. Employees by definition are not smart. If they were, they would run their own places instead of contributing their service to an employer for a pre-agreed fee. As always when less-smart people are in-charge, productivity falls.

You wake up every day and show up in office is an attitude setter work-ethic. People prosper because of it. Refusing to show up in office by some of the employees is a raw disrespect to the employees who show up in office daily. To me, if all of them are not in office, then all of them need to be working from home. At least there is no office rent expense or maintenance. That is a better option as the fall-out will happen sooner.

The problems gets worse as you go west. In the US, the post-pandemic work culture ethics has hit new lows. We see them in productivity numbers. In year 2022, US has lost full-time jobs and created a lot of part-time jobs. By definition part-time jobs are "manage" jobs. You don't have to be fully involved or dedicated but keep a guard on something until the next part-time guy shows up. It's more about the time-factor rather than the work-factor actually. Usually the jobs are repetitive, mundane, uninteresting and will not be done by someone who are more ambitious. For the lack of better word - they are dull jobs done by dull people. I always thought, a family of 4 needs just one person working a full-time job and that should be enough. More than one job in a family - is a sign of weakness and not strength.

There is only one place to blame for this entire mal-function in the work force. It is the Western Central Banks, in the US Fed, ECB and BoE. At the time of pandemic, when the supply was less because of lockdowns, instead of reducing the demand proportionately, they stimulated demand by bring down the interest rate back to zero and the government providing welfare stimulus checks to people who are unemployed and provided PPP loans to businesses to make people employed during the pandemic season. In the US, the entire country was in welfare. It was to ensure people do not come out for the sake of money during a global pandemic. With most Americans devoid of savings, and living life, pay-check to pay-check, this was a humane thing to do. But what really precipitated was - the welfare programs ran for months. Nothing is permanent than a temporary government program. Evacuation moratorium was done which guaranteed people can stay in their houses without paying the rents. With the free money coming in - people earned more than what they earned while working in the jobs, didn't have to pay the rent, don't have the expense like gas to go to work, they spent all their money online on amazon while watching Netflix in their couches. It's all OK, except that no country can afford that. The pandemic exposed the hollowness in how the western economies operate. Lack of productivity was inherent over the last decade, the pandemic put a confirmation to it. Even before the pandemic there were more women workers than men in the labor force, underscoring the less-productive aspect of most jobs.

Human labor is scarce., like everything else in this finite world. Tying up a few people to do unproductive nature of work for a long time, irrespective of their monetary channels is a fraud on nature. If resources are not productively used., why does it matter if they are paid or not. Doing things in 2 months what ideally takes 2 weeks because of operational lethargy, is a disservice in my opinion, though it might be defined as unproductive labor in the law of economics.

The experience of going through this and not able to change anything about it in a meaningful way, is a new low to me personally. I get over this by thinking, after all - It's just a job! Only the market has to fix it. It definitely will. Unfortunately lot of damage would have already happened.

Saturday, November 12, 2022

Remote work insanity

Sunday, June 12, 2022

Looming large layoffs

The US inflation data (CPI - consumer price index) for the month of May came out last Friday and the print was 8.6%. Putting to rest the optimism that dominated the financial media since the last receding CPI number - that we have already seen the peak of inflation. The 8.6% was a new high for this cycle. The core inflation also came higher than expected. This would be highest it has been in 40 years. What would make it worse is - if we measured the CPI the way it was measured 40 years ago, the number now, would be well more than 15% already. That number would have taken out the historical high of 13% of the late 1970s.

Gas prices hitting $5/gallon across all US cities this weekend confirmed the pain at the pump.

The university of Michigan consumer confidence sentiment number came out and it came in around 50 - the worst in its 70-year history. Consumers think this month is the worse month than anytime in the past including the 1970s peak oil crisis, 1980s inflation, 1987 black Monday event, 2000s dotcom crash, the 2008 great financial crisis and the covid pandemic from last year.

The S&P 500, the thermometer of the US economy, had its worst start to the year in a 100 years. The bond market arguably had its worst start to the year in 200 years. Inflation possibly at an all time high - things look lot bleaker. Only thing that is going good is the fact that Americans are able to cling to their jobs with unemployment at a low at 3.6%. The jobs market will reflect the economic reality in the 3rd and 4th quarter of 2022. The huge lay-offs are coming. Unemployment is a lagging economic indicator always and the carnage is just ahead of us.

President Biden, this week had the courage to say - the American people are capable enough to meet the rising prices head-on because the labor market is good. A true admission would be to acknowledge the past mistakes of fiscal & deficit budget policy since the global financial crisis of which he was very much part as Vice-President in the Obama administration. With the job market beginning to show cracks (the initial jobless claims from last week coming in 20% more than expected. We might have seen the bottom there already).

Inflation - is the most misunderstood concept globally. Milton Friedman said - Inflation is always and everywhere a monetary phenomenon. Expanding money supply causes inflation. Inflation is the expansion of the money supply and price increases, are consequences of it. In other words - if more money is printed and are in circulation, the prices of available products will go high. Printing the money is the easy part, producing the consumer products is the difficult part.

Price increases affects everyone in the society. When i say price increase - i mean price increase of "everything". In the modern way of financial capitalism, we have been made to think, prices of food/fuel/utilities going up are bad and prices of stocks/homes/wages going up are good. why should that be? When you purchase a home and the price of the home goes high - people feel happy. When you purchase stocks and the price of the stock goes many folds - people feel happy. When the stock market indexes go higher and higher - people and business feel happy about it. What they don't say you - this too is inflation and it is bad for the economy. Only when the price of food, fuel and all consumer prices goes high - it is considered bad which is pretty unfair.

In reality stocks of good performing companies can go high as they add value. but all stocks going high is a problem. Wages or Salary is just the price of labor. When my salary goes high at work because I'm more productive compared to others - then its a good thing. If everyone's salary goes high in equal percentage amount - what difference does it make? when workers productivity goes up (enhanced skills, mechanization and automation) - cost of production becomes cheaper. In an society with productive labor - prices of commodities fall.

With the price of stocks/bonds/homes increasing multi folds in the last decade, the inflation was ALWAYS there. It just started to show up in the CPI components. I really think - CPI data must include speculative and risky assets like stocks/bonds/wages as it components. It must also include home prices, not rents (which get manipulated by owners' equivalent rent - which no one pays!). That would be a more accurate of consumer prices. The case-shriller index that measures the price of homes came in last week - home increased in value by a whopping 21% across the top major cities. What would be the CPI print, if they add this? no wonder they don't add this number to the CPI.

Below is the yield on the US bonds as of this weekend.

Why would anyone buy the US 2 year for a 3.06% coupon, when the official yearly inflation is 8.6%? If you buy the bond today - you are guaranteed to lose money (~5.5%) when you get your principal back in 2 years in lesser valued dollars. Why would anyone (looking to profit) will buy the US 30 year for a 3.2% coupon is beyond human intelligence. The average inflation for 30 years must be around 2% is what the buyer is thinking., so that he can benefit 1% from it. Say if the inflation stays 4% for few years, to average it out - it needs to be sub 0% for few years to maintain the 2% average. The probability of this happening is almost 0. In a real free market, these conditions will not exist. Also on the numbers, you can see the 3Y inverting with the 30Y (called the inversion of yield curve) signalling something is broken already or something is about to break.The fall in the stock market has a long way to go and the odds of a flash crash is very much possible.

There is definitely a huge difference between people parking their hard-earned savings in US bonds and the Central banks buying in the open market what was originally theirs anyway.

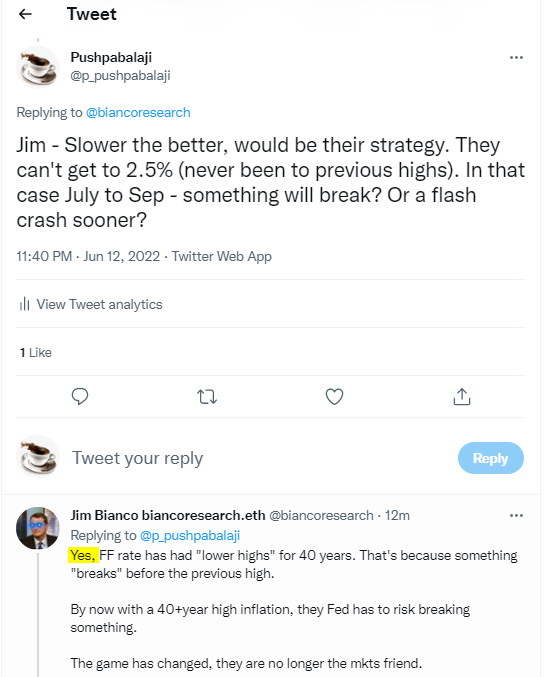

With inflation getting hotter and hotter, the US Central bank has to raise rate. They will do a 0.5% this week. What good does a 1.25% rate do to a 8.6% inflation? Nothing! They can't go to 2.5% is what i think (Jim Bianco agrees with me! - see image)

What I think, they will end up doing is - they will raise the interest rate high enough to cause the recession (most likely depression), but not high enough to solve the inflation. A higher interest rate than the inflation rate would be the right thing to do - it would just blow up the entire global financial markets within hours. (if doing the right thing causes more pain - then you know its all messed up disproportionately)

The recession will cause the job losses. A lot of them! The looming layoffs on the horizon is not a hurricane but the hurricane. Imagine having a beach ball in hand and holding it above your head. it is hard to convince someone, that you will take the hand out and the ball will not fall. It has to & will fall.

The tech stocks & the cryptos have taken a hit already. The coming lay-offs are going to be huge and unprecedented. Because the boom from last decade was unprecedented, the bust has to be proportionally bigger. The tech sector will be annihilated similar to the dotcom crash of 2000. What we have there is a massive bubble. The air has already come out of it. It's just a matter of time (weeks), reality catches up. The industry is just unsustainable in its current proportion. It needs to be lot leaner. Tech-oriented Nasdaq chart is below (see image). The circled portion is what was the 2000 dotcom crash. If that kind of fall from 5000 points to 700 caused so much pain, imagine the fall from 16300. You can see from the chart image - the slide has started and its just accelerating. Almost all tech stocks are down 30% or more this year, including the big names like FAANG (Netflix is down 70%, Amazon is down 35% from their highs from November). When valuations are hit this much, the tech employment has to take a hit too. Believe me - this is just getting started and it will get very worse very soon.

The great financial crisis of 2008 was essentially a US housing problem. I am a living eye-witness to that mess and so are many who owned a house during the spectacular boom and the eventual bursting of home prices in late 2007 and into 2008. Prices of home crashed, in some cases more than 50% and every bank which loans money to home owners failed. The government had to rescue the entire housing market and ALL the banks. The entire episode can repeat again. I think it will repeat in a even more worse way for the following reasons: (unlike last time) People well remember fresh in their mind, the loss on investment on housing in 2008 did. Once they know, the house price is starting to fall, everyone might head to the exit exacerbating the problem further. More houses will be put for sale and no takers. The word of smoke can create a stampede at the doors. If you think the high prices of 2007 caused the housing collapse, its even higher now. The mortgage prices have gone from its low of sub-3% to close to 6% now. Even though the 6% is less than historical normal, with the prices at sky-high, its lot of expense for the new home owner. When people start losing jobs and cannot afford to pay the mortgage or have to relocate to take another job somewhere else - and want to sell their homes, it will cause a housing crisis of at least the same magnitude. If you are not convinced yet the housing crisis is on the horizon - look at the mortgage application data from last month. It was down 22% and this is a 22 year high. And then you realize that this period includes the housing bust of 2007. Let that sink in.

Even though it will be unfortunate and painful for people to lose their jobs, in the long term - this is exactly what we want. Particularly in technology, people are over paid and a lot of jobs are not "impact full jobs". Scarce human resources are seriously miss-allocated. Instead of being fearful of the recession, we need to embrace it. The mal-investments of the last decade needs to fixed. The market has to do that. Failure to rectify this at this point, will make it far worse in the future causing even bigger pains.

Monday, April 18, 2022

It looks very scary!

Imagine being on an intercontinental jumbo flight, which is full with passengers, the pilot has just announced the power to all the engines are lost and they are about to crash land into an open space on the earth, nose down. What would be in the minds of the fellow passengers?

Anyone who is remotely aware of the US bond market carnage of last month can contemplate this same feeling about the fragile US economy that is about to crash land with assured causalities. It is almost certain there is going to be a crash landing. What is hoped for, there is a some kind of safe landing where only some get affected. It is almost impossible to save all of them or at least majority of them.

The bond market has been virulent in the last 4-8 weeks. Yields rising more than 100 bps within a month or so in both short and long-term bonds. There is literal blood-bath. The total return value on the bonds has not lost this much value within this kind of a short time span in recent memory. Jim Bianco says, this is the worst bond market blood bath in our lifetime so far. Unfortunately there isn't a stop on the horizon. There is no bottom coming. As of this morning, the 30-year is knocking on the 3%, trading close to 2.96%. The 10-year, isn't far off at 2.86%.

The yields on the bonds move opposite to its price. With rising yields there are no enough takers. Peter Schiff says, It is right, the bond market is pricing in a recession ahead of us. The recent inversion of the yield curve rightly suggests that. What they are not realizing is how high the yields are going and how fast it's going to happen.

The carnage in the bond market is not being noticed by the stock market. If the yields on the bonds keep going this way for say another 3-months., the yield on the 30-year may well go past 5%. This obviously is a negative for the stock market because people would opt for risk-free returns than the risky bet on the stock market at current high valuations. The yields going further would cause a bond market crash. Once the yields go past these smaller numbers, existing bonds would lose a lot of value. With the Fed going from a net buyer to a net seller - There wouldn’t be any takers for the bonds. With planned deficit budget and trade deficit for the coming year, the government is only going to borrow more.

The vanguard bond portfolio is down more than 8% similar to the stock portfolio YoY. If the so-called, bond safe haven can lose 8% within a quarter, just imagine how much the risky assets possibility of huge falls. The yield on the 30-yr is going to rise further and further. The only thing that can stop this is a stock market crash. If the stock market doesn't crash, the bond market definitely will and that will crash the stock market too. There isn't lot of good possibilities actually. The Fed has promised to raise interested rates by 50 bps, when they meet in first week of May. The Fed is very late already. The bond investors know it. What they don't know now but will eventually know later - is that the Fed will give-up on its inflation fighting goal to save the economy.

The inflation picture now in the US is abnormal to this generation of people. The American public has lived in a no to low inflation zone for the past 40 years. Paul Volcker raised interest rates to 20% to tame the high inflation of the late 70s and early 80s. Since then the bonds had been in a bull market. Alan Greenspan introduced the American public to low interest rate regime during his tenure at the Fed. The housing boom was caused by it. Once the interest rates started going up, the housing bubble burst causing the great financial crisis in 2008. As part of the recovery from the financial crisis, the economy was boosted with even more of lower interest rate regime and multiple quantitative easing (QE) also called stimulus - to create multiple bubbles under Ben Bernanke. Everything was OK until the US saw inflation creeping up. The inflation in Feb 2021 was a 2 handle. The YoY is now up to 8.5%. The rapid ascent in inflation is relatively unheard of in recent US history. It has brought jitters all over.

Import/export data came in last week. This is probably more accurate than the CPI because it is not manipulated by the method of measurement. It's just plain dollar amount of prices. They run more than 12% YoY. The retail sales up by 0.5% ., and just 0.2% excluding Food & Fuel - confirms the customer is thinning out and isn't spending as usual. The true inflation is really biting the American household.

Without a fundamental shift in asset prices, the economy cannot be resolved to its neutral value. For this to take place - interest rates need to go higher and got to go higher faster. In all of this., the Fed has just started. It is moving interest rates by 0.25 is too slow compared to the unfolding price increases across all products and services. Of all industries the tech seems will get hit first.

Tech-bubble has already been pricked. After the smaller tech being hit hard, now the darlings of the last decade are getting whacked. We have seen the big-tech (FAANG) now getting hit. Most of them are already in bear market territory or just be there soon. Other non-FAANG darlings like nvidia for example is down more than 35% from its recent highs. The Banks are getting killed too. They are all trading well below their recent highs, some to an extent of even down 40%. With mortgage rates now staying more than 5% - the bottom trend in housing is just round the corner, probably it's in the next slide.

We can say the one and the only thing - that is going the Fed's way is that the unemployment figures are lower at 3.6% and the job creation is OK every month. As the stock market and the bond market bleeds in blood., it is just a matter of time - the layoffs starts. Eventually this would happen. Markets keep going down and jobs being created every month don't go together. Also, the worker productivity has gone significantly lower since the pandemic after the "work from home" habit. With workers sitting in their living room couches, innovation (workplace creativity) is not triggered. Direct interactions with team members, discussions, working at arms-length create an innovative work culture.

The Fed will raise interest rates until something breaks. At this moment, it doesn't have any other option to save its face. It wants the market to correct significantly but at the same time doesn't want the economy to enter a new long painful recession that could run for years. If the stock or the bond market crash even before the anticipated rate hike - it would put Fed in a really bad spot. At one point or another - To make the market happy, the Fed has to backtrack and go back to accommodating monetary policy again. That may create all sort of new problems along with history!

Friday, January 14, 2022

Easy money Hard pains

For the past 20 years or so, America has solved its economic problems by doing pretty much just one thing - printing new money (USD).

Alan Greenspan, after the burst of the dot com bubble reduced interest rates to 1%, left it there for longer and thereby causing the housing boom. Without the 1% cheap money from the FED, the housing prices wouldn't have risen. The housing boom burst in 2007 causing the financial crisis in 2008, and Ben Bernanke reduced interest rate to 0%. When growth didn't improve much until 2011 - he did multiple QE s and interest rate manipulations like operation twist. In simple English - America printed new money and funded the economy in the last 2 decades.

To climax that out, once the pandemic hit, printing new money was so rampant, the American tax payers just became irrelevant. The usual tax deadline of April 15 was postponed as it wasn't necessary. Some even suggested, we abolish the IRS and America can print its way out to any growth levels. Of course - it can't.

What was surprising during this time was - None of these new dollars caused inflation - officially. This is because of changes to the methodology of how the CPI was measured, lot of dollars ended up being outside the United States rather than within the country primarily because of import dependent economy.

With endless money printing, US seems to have reached the end of the rope now. Out of all the problems it can solve with money printing, one thing it cannot solve is to fix the problem of "domestic inflation".

Domestic inflation now in the US is 7% as per the CPI data released this week. The PPI inflation is more than 9%.

The Fed has come out with its reaction - they will trim the monthly Stimulus and stop it by March. Then they would raise interest rates through this year and next year. They say - we will be just under 2% Fed funds rate by end of 2023. The problem with this argument is - how come a 7% inflation problem be solved by 2% interest rate 2 years from now. It sounds really dumb. Cruelly no one is questioning that enough. Fed is clearly behind the curve here. They are trying to play catch-up. It looks too little, really late.

Any rolling back of easy money policy will cause economic crisis. It looks the tech-bubble and the crypto bubble have already been pricked as a result of the Fed's change of course. We need to see through 2022 to validate that.

If you took S&P 500 since the pandemic hit - it's up 30%. If you remove the momentum stocks FAANG out of that (meaning S&P 495) - The S&P is up 0%. That is the harsh reality of it. As stock market veteran says - The soldiers get killed first and then they come for the Generals.

One other clear sign of topping - Apple is a 3 trillion company in market cap. It is more than the Russel 2000 put together (all two thousand companies put together). India is a roughly 3 trillion economy. Apple, a mere cell phone/laptop making company replacing an economy of a billion people explains how big the bubble has got. So really looks the top this time.

The tech-savvy NASDAQ hit a correction territory already this week for a dead cat bounce. It will head down to it again soon. Of course, to go to the bear market, it needs to go to the correction territory first. Without an assurance of further easy money - I don't see how the already leveraged tech-industry can go higher still.

The crypto also seems to have topped. Bitcoin and Ethereum - top couples seems to be breaking down on critical levels. With the bond yields increasing - the backbone seem to be bending. What out for this one - the market seems to be crumbling down with no bottom in sight. The total recall (bond price + its remaining yields) crashed most last week, a level unseen in history.

Milton Freedman told inflation is completely and everywhere, a monetary phenomenon. Rising prices are consequences of monetary expansion.

What exposed the underlying sick US economy was the covid pandemic. With no savings in American families, the US government didn't have an option but to send people bank-checks, that they can cash in to survive the pandemic period. Without which people would have ended up in the streets without job prospects during a pandemic in play in the entire world.

If easy money pumped up asset prices, then by definition rolling them back would reduce asset prices.

The problem of inflation cannot be solved by any other means but by sucking out dollars in circulation. The trick would be to do that without causing a recession. Doing this is impossible taking into account the current outstanding debt.

Fast depleting worker productivity of the US worker is very concerning. No society can keep on consuming without producing the commodity. The labor productivity crashed, to a low of 60 years recently.

What is going to happen in 2022 is going to be interesting. This would be first year since the financial crisis - we have a really hawkish Fed with a job on its hand to solve the inflation mess. It's affecting all people and the ruling Democrats want to minimize the pain before the mid-term elections in November.

Doing the right thing now - is not monthly quarter percent hikes over the next couple of years. What is needed is interest rate going to a number more than the 7% inflation number, say 8%. On top of that, roll back all QE programs and Fed has to reduce its balance sheet meaning instead of being a net buyers of US Treasuries, they need to be net sellers. The sad fact is - none of this is possible without crashing the whole economy that would make 2008 great financial crisis look like a walk in the park. On the other side - what if inflation goes to 10% or 15% or 20% ? That would need a even more bitter medicine to a even sicker economy. The Fed has really trapped itself to a corner and it doesn’t have a painless option. More than anything else - the credibility of the Fed is challenged. They had to go back on the word "inflation is transitory". It was a big miss when you have 800 PHDs in your payroll. It was absolutely clear - inflation was persistent and nowhere transitory. To save a daily insult - the chairman had to go out of the way to "retire" the term transitory for everyone. Reminds us all about Ben Bernanke - who infamously told the US Congress, the subprime crisis was tiny and will not affect the housing prices - only to see the entire mortgage market was toxic to its core triggering a global financial crisis unseen in generations.

Overall 2022 will be the year of rampant inflation. The 7% is just the start. The FED has to raise interest rates very aggressively than they think. Every time this has happened - something broke causing a crisis. This time is no different.

Wednesday, January 12, 2022

The desk jobs

A fundamental truth in mankind existence - a thing cannot move from one place to another, unless a human labor is involved. An object stays in its place forever unless someone acts on it. Also its true -> an individual cannot do anything by himself alone, no matter what. Even a genius scientist who finds a medicine for a deadly sickness, uses a table and chair for his experiments, things made by someone else. If he wrote his findings - someone made the paper and someone else made the pen. So the fundamental unit of change is human labor.

Most of world's history - individuals worked for themselves only - in the form of finding his basic necessities like food, clothing and shelter for his own survival. With his life being threatened by wild animals and other components of nature, he determined that he has to associate himself with a group of people, like a family or a working community. The search for needs was discovered to be easier when done in groups. Group ism created more bounty for the individual effort, with common wisdom from experiences of all.

Later on as tools and machinery got invented, the labor moved from being physical to being less-physical. The nature of jobs moved from agriculture to manufacturing to providing services eventually.

During this transition in the last couple of centuries, some individuals within the group became smarter and smarter compared to the rest - they began to work for others for a "reliable" income. Employer-employee relation would eventually become an organized mode of extracting human productivity after the invention of needed tools, that workers will be trained to operate over time.Eventually the employers became co-ops, companies & corporations.

Western economies of the last 2 decades have become service economies for the most part, with very little trace of manufacturing (producing products).

Gradually the western world has evolved to basically this - Bulk of the employment is "desk jobs". It's like people playing some kind of video games from their chairs. Apparently they are ALL creating value doing that. I wonder in most cases - they aren't. At least not in its fullest definitely. Are you asking, if all of them are unproductive - no. Some of them definitely are. But desk jobs cannot be 100% replacement for real manly jobs that need hard physical activity. Machines have replaced most of those jobs - which is definitely welcome, but the so called 20th century jobs are definitely way inferior to what mankind ever knew.

How did a superb

performing US economy, which pioneered production manufacturing lines making household products (that improved quality of life for all humans across the globe), reach

this pathetic state. Surprisingly all this happened in spite of a purely capitalistic model - It's all private owned.

Productivity was keen.

Human resources as any other resources available in the world are scarce. It is hard to get people with specific skills and importantly with the needed attitude. They need to be utilized right and productively. Labor is precious.

The services industry has grossly mis-allocated resources, the way it is practiced.

It can be said almost with certainty that a factory unit, producing a product is 100% productive. They will never manufacture anything that is not needed. Products produced will be consumed in one form or the other. If they produce something the market doesn't need - they will change course right away. Workers would be made to do something else - that will be used by someone else no matter what. A badly made apparel in a Tirupur factory will at least be used as a waste cloth for years. Unfortunately you cannot say that in your desk jobs. Not all of the things that are produced are really used somewhere usefully. In desk jobs, it's very common for workers to do products (documents, reports, software, analysis etc) - that no one uses. They lay on broken hard disks. What was the cost of money & time to accomplish it? More importantly, who paid for it?

When I went to the US in 2005, I would see this on TV often, George W Bush, then US President would come on prime time and would say that the Americans are getting ready for the 21st Century jobs. He would say this when asked questions about the depleting manufacturing base and loss of blue collar jobs across the country. It was like the average American worker will not participate in producing day-to-day needed products like - toothbrush, paste, soap, table, chairs, sofas, beds, pen, pencil, books, fans, washing machines, tv, electric appliances, etc. These things need resource intensive mode of production - and thus can be done by people from poorer countries. American workers would do only cutting edge items like - building airplanes, rockets, military submarines, R&D, high-end technology and similar jobs that need expertism. In theory - it would be correct. In practice - it just didn't work that way. Doing difficult things is being productive. What really happened - most American workers were not ready for the so called "21st century jobs" and their standard & quality of life started falling. Bulk of them left the labor force because they couldn't hold on to their jobs. The labor force participation rate has been going down for years now & right now, it's around a pitiable 60%.

In the US, Women made the bigger work force than Men in last couple of years. Leaving aside the gender discrimination aspect of it - a quick dissection that will lead to an arguable thought -> Women have a different physiology and cannot do lot of things like men. One obvious thing - A man starts his "working career" sometime in his 20s and will be in the work force continuously until they retire in their 60s. But the women - they cannot be in labor force similar to men. They take career-breaks during pregnancy. They take care of kids after that. By nature, they raise families. Their role there as a mother & wife is very unique. This distracts them from focusing fully on their jobs. Because of this, employers tend to pay them lesser which is understandable. For the society - more women being in work force compared to men is a sign of falling productivity and not increasing productivity.

I was talking the

other day to someone at work. With the covid restrictions kicking-in, they were

getting a count of who will be in office and who would work from home. He just

said - he will be in office. Turned to me and said, when at home, and sitting

before a computer all day - his mother doesn't even consider that as a labor

happening. It is very common for them to ask him - Can you please go and do

this errand for me. I just see you sitting before the computer and unsure, what

you can possibly be doing. It looks there is a whole generation of people who

think -> sitting in a table/desk in front of a computer screen is void of

any labor activity. The productivity is undefined and obviously unnoticeable.

The invent of Social Media (SM) over the internet is a considerable distraction

for desk jobs too. You could spend hours and hours looking at SM pages

scrolling down & down and not benefit anything at all from it all day. For many people - it turns out to be addictive.

The covid pandemic has come as a huge storm into the existing way of employer-employee relationship. With things back to falling in place now slowly - the old way of operation is probably gone. There is going to be a new kind of set-up. One thing that the pandemic has challenged - there are some jobs that can be executed remotely. If they can be executed remotely - what difference would it make to do the remote work from New York City or Nigeria. It doesn't make any difference as long the "same work" gets accomplished. Also the time zone in which they operate is not simultaneous but sequential. This ought to bring more efficiency.

One word that was used more frequently and not being in use at-all these days is - globalization. This term essentially referred to the employer going global leaving out the employee of the region. If the jobs are essentially desk jobs - what is going to happen is, the employee is going to go global sitting from his chair. He is no longer tied to his employer in his geographic region. He can work for anybody. This will play out eventually in the following years. This wave is coming and it's going to shift the employer-employee set-up we all know.

The pandemic of the last 2 years, has redefined many things. We just sent all employees home for 2 years which is quite unheard of. Things are holding up still, if not normal. It doesn't look like we are going back to 2019 when the pandemic is gone. People's preferences have changed. There is going to be a lot of give-and-take in the employer-employee set-up. Ultimately the market is the best judge. Market has & will always do a good job of allocating resources. This time at the global level. Weaker links get broken, stronger resources get better. The post-pandemic world has more surprises waiting for us. It's interesting times.

Monday, November 22, 2021

Crazy Cryptos

Any discussion about economic bubble mania always use the "Tulip Mania" as an example. What is more astonishing is - the mania happened in Netherlands in the period of 1630s and we still use the example very vividly even though it happened almost 400 years ago. I am not sure why THIS mania is remembered fondly compared to thousands of other manias that followed it. But I am sure - the next 400 years, future generations would talk or ponder the crypto mania we are engulfed here in our generation as the worst part of human greed and irrational exuberance to its core.

During bull markets, prices of assets grow to new highs and gradually recede during the recession that follows it. Usually crazy things happen in few specific sectors of the economy. Unlike water, the "new money" does not balance at all the same level. It so happens - some sectors of the economy get very hot - really hot and start operating without logic. Eventually as the recession hits through - the astronomical prices come down crashing. It was the dotcom crash of 2000 that brought the tech stocks to zero and the 2007-08 housing crisis, bought the prices of US homes crashing by more than 50% across most of the US cities.

The current boom we are in is being rightly described as the "mother of all bubbles". Definitely the tech stocks are over-priced and the NASDAQ is more than 3 times what it was in year 2000. Housing prices are now at its peak - well above its 2007 highs just before the crash. It can be easily argued the US bond market is in a bubble as well.

Unlike earlier boom/bust cycles - it appears the boom is in danger zone in multiple sectors of the global economy.

But out of all these, nothing is so screwed up like the entire crypto market.

There are quite a few things that are bad in the crypto market.

An asset has to have an intrinsic value. When you take a home, people live there. It has a utility value. There is a need for housing. It is a place, people can keep themselves warm or cold from weather changes. Its where you keep your belongings safe. It has a use value. Because of its use value, it has a proportional exchange value. Home owners sell their homes for getting cash and use the proceeds to buy another asset . Assets such as home will always have value because it has the fundamental components of productivity - land, labor and capital.

Other assets like stocks - represent a piece of action in a profit making businesses. They have an intrinsic value. The business has assets and employees with skills who can make the shareholder money in the long run.

Every boom period is defined by something new. The newest girl in the block always gets a lot of attention. This bull market that is in place since the 2008 financial crisis has created huge asset price appreciation overall. The causes being the zero percent interest rate policy of the world central banks and endless quantitative easing measures the world hasn't seen. With the covid arriving early in 2020 - Every boom has been re-catapulted with more stimulus. With "free money" everywhere, investors have no choice but to buy risk assets all over the world. That would explain the exponential growth of the crypto market.

Cryptos have all increased in value during this phase of the boom. For example Bitcoin has went from few dollars into its all-time high of $68000. For anyone who made the journey they have profited exponentially.

No asset go up in price for ever. For those investors who missed the bitcoin ride regret not being able to get in to the ride when the price was really in double digits or even triple digits or few thousands. For those investor who got in and burnt themselves in volatility know the high price of losing the money on the way up. But for me - the best investor are the ones who will make the sane decisions and stay normal during crazy times. I have been watching bitcoin when it was as low three figures. When it reached $4000, I thought it was way expensive then. Today its $68000 - of course it's way expensive now. Can it go higher and higher still - Of course yet. Can it go to $100,000 - Yes, it can. Can it go to a $1M - possible but not probably. With each coin costing a million, it would seriously undermine other monetary parameters.

The cryptos are digital meaning you need to go online to view or see it. Its virtual - which is it is not fungible (felt or touched). Peter Lynch in his "Beating the Markets" says - the investments you make on businesses must be explainable with crayons. There are many things that can be explained - but not the cryptos. People who have no idea about cryptos - don't invest in them, and the people who do -> think it's very valuable. Only way out for someone who is holding his bitcoin is to sell it to someone who is willing to give more money than what the seller paid for it.

Crypto currencies by itself are transmissible tokens via the internet. It can be exchanged between the crypto valets of users. That's all it is. Their value is only exchange value. There is no use values. Meaning people will not buy it because there isn't any use to it, they will only buy under the belief that someone else will be willing to pay more for it in the future. It doesn’t solve any problems. It takes a lot of electricity to "mine" the cryptos. The cryptos are end product of the mining operation. If it's not useful by itself - what is the purpose of "mining" them.

One of the big drawbacks of the cryptos is its lack of simplicity. The medium of exchanges is not physical. It is online. With a large population of the world outside the internet, it is not sellable to any larger public.

If you have a checking account in the bank and you are able to digitally transfer funds to your friends and family 24x7 and to any part of the world - That is a reasonable mode of exchange that we know works well. It solves all problems that bitcoin tries to solve. When you are without an internet or a power supply, you will not be able to do a fund transfer in your bank account mobile app. It’s the same there too. If an bank account can facilitate exchange of currencies online - separate channel of mechanism is redundant.

Because they are not useful by itself - when the confidence is lost, the price of the cryptos will go to its minimum of zero. There is a precedent to it for us. The dotcom companies who made spectacular stock market debuts in the 1990s - eventually went to zero when reality caught up with it. The same is true for today's cryptos.

One of the big talking points of bitcoin enthusiast is its scarcity. They say there can be only 22M odd number of bitcoins ever. Even though there may not be enough bitcoins, there are enough crypto currencies, actually 13000 of them that are being traded. Even within bitcoin there is a "bitcoin cash" which operates along with bitcoin. It’s a separate crypto that operates outside the 22M limit. So the whole things is very unconvincing and we hard to explain even by the so called "crypto experts".

Centrals banks printing money has dramatically increased since the great recession of 2008. Bitcoin enthusiasts point to this obvious problem with the fractional reserve banking the world economy follows quite rightly. They advocate cryptos as financial instruments that is outside world governments. They often site it as free from government regulations and its uncontrollable independence from any entity. The individual countries stand behind their currencies. Even though we do agree with the problems world Central banks have created - crypto is not an effective alternative for it as it lacks a lot of other qualities of sound money.

Internet is a life changing invention. Most of its value derives from its experience of being mostly free. It doesn't cost much to be using the internet. Say If popular social media sites like FB are made payable site. The traffic would come down to single digits overnight. For most people, its optional meaning they would want to use it only if free. If its chargeable - they will choose to ignore or choose an alternative site, that is less sophisticated but doesn't cost any. Unlike the internet - the cryptos are not something people cannot live with.

The astronomical valuations of certain cryptos confirm the big asset bubble the world has ever seen. It is very hard to believe - it will gradually smoothen itself to a new normal. There is going to be adjustment and when it happens it will be more painful than before as the monster bubble is massive this time.

Eventually all cryptos including bitcoin will go to zero as that is where it belongs.

Sunday, November 29, 2020

Why this world needs a Gold Standard!

Gold has been an investment for hundreds of years and at this point of time in history, its relatively under owned.

To put it in perspective, there are some myths about our understanding of certain financial terms.

"Money" is something that has intrinsic value. Additionally it should also be a store of value. There should be a natural demand for it. Gold is money. It is possible any commodity can be money. For example - oil can be money. It has a intrinsic value and store value. We can run automobiles after scientifically processing them. There is a natural demand for it. It is however not portable, fungible or easily exchangeable. The precious metals - mostly gold and silver have always been used as money since mankind evolved. Their availability is limited and people have a natural desire for it.

The US constitution mandates only gold and silver as money. No where it talks about dollars. Dollar bills were mere paper bills or IOU, that represented the gold it was backed on. It was used for convenience and never by itself a money for most of American history.

The US Dollar or the Euro or the Pound or the Indian Rupee is NOT money. They are currencies. By itself - they do not have any value. The government prints it on paper and mandates the collection of taxes and commerce on it. It controls the supply of it by controlling the flow of it - often referred as liquidity in financial terms. These paper currencies are fiat currencies and should not be called money. They are currencies. The demonetization that happened in India few years before - made most of the existing paper notes invalid. Overnight they lost its value. It was substituted with new paper notes. It is a recent example of a fiat money losing value overnight, if the government that controls it wants to do it.

Usually there is lot of argument - if gold is an investment. Gold is not an investment. It is a store of value. let's see what this is.

Say you have a capital amount of say, Rs. 50 Lakhs to invest. You have three choices

1. Keep the currency in a safe

2. Buy physical gold with that money say 1 KG and keep it in a safe somewhere

Also note, we can buy a luxury car today, that cost Rs. 50 Lakhs.

Sometime in the future, that can be say between 2 years to 100 years, you come back to this "investment". This is what you realize

1. The currency in the safe is as is. But the currency buys lot less than it used to be. It might become completely worthless over time.

2. When selling the gold in the safe, it gives me the exact value, as of in today's currency value that helps me to buy the the exact SAME thing I wanted - in our case the luxury car.

It should be obvious with this example that gold never acts as investment. It just stores your purchasing power over any number of years. The other way to say is - if you are young and energetic and happen to have a job and make x amount of money over n amount of months. If you end up investing everything in gold at the current market price every month, then what you are assuring yourself is - at any point of time in the future for any given month, you can see the x amount of money and live your life with the same life style for the month. As an example - if you saved for five years of your monthly salary amount in gold now., you are guaranteeing yourself that you can use that money for "any five years" down the future and you will be able to do the exact same thing you can do it with now.

Governments control money and as always they are not good at anything and this one is not an exception. They have convinced the world that little inflation is always good. The price of everything going higher is always a good thing. It is not. It helps those people who have heavily borrowed money. It does not help the savers who have dutifully saved. In other words - the risk taker is rewarded at the expense of the conservative saver. This has caused the economic malfunctions the world is facing now. Had there been a fixed money supply - it would guarantee stable prices. The industrial and technological inventions would cause prices of everything to go down because of increased productivity. The world the way it operates now is - completely backwards. The government along with its special interest group (who benefit from this set-up) - keep this game going for their own convenience. What is very sparkling in history - This always happen and people force governments to go back to the gold standard. This is often economic failures or revolutions that throw out dishonest governments and their quasi entities that benefit from it, who promise economic prosperity without human productivity.

Now we look around, in the post covid-19 world, the major channel of investment - pretty much boils down to equities. Equities are all at an all time high, primarily facilitated by easy currency policy of world central banks. Buying the US Treasury 10 year bond for a yield of 0.7% interest is well below the government statistics of 1.5% of consumer price inflation. It clearly says that any buyer of a 10-year bond, is guaranteed to lose money if he holds it to maturity. This is a bad investment and no profit-oriented buyer will buy it. Because the central banks are in the bond market buying bonds - the entire market is phony. The only option is to sell the bonds to the Central Bank for a profit. The Bank doesn't care - as it just prints currency bills to buy the bonds. There is neither an investment or productivity involved in this transaction. Bank of Japan has been following this for years and literally days goes by where not even a single government bond is bought or sold.

Bottom line - With all Centrals Banks printing currency bills like crazy - the general inflation is only going higher. Gold is the only hedge to this rising inflation.

Whenever you are upset with the current governments and their lavish spending spree's, throwing and wasting money (currency actually) in the name of people's welfare - what you do, is you take your savings and head towards a precious metal seller and buy yourself gold and silver. That is the only way to be prudent.

Right now - all economies of the world are socialist economies. All governments are propping up private companies that should be allowed to fail. We are all Marxist now. Capitalism cannot be good when things are good and cannot be seen as evil when things are bad. If capitalistic economies cannot stick to free-market principles during bad times, the collapse of the system has already began. In the US for example - the amount of new currencies printed in the last 3 months exceeds the amount of currencies ever printed in the history of United States. This won't have bad after effects is not believable. Even if things come back to normal - what is the plan on re-introducing capitalistic principles again? The federal budget deficit is alarmingly high. It is expected to remain high for the foreseeable years.

If governments can print this much currencies in this short time, and it does not create any problems - then why even do taxation? We can repeat this every year and it should make a difference.

The whole indebted western economies are more and more cornered. The only thing that people should hedge against is the future inflation. Gold and Silver offer that.

People say, we cannot go back to the old standard. We are not going back to the old standard. We are going back to the good standard.