The US inflation data (CPI - consumer price index) for the month of May came out last Friday and the print was 8.6%. Putting to rest the optimism that dominated the financial media since the last receding CPI number - that we have already seen the peak of inflation. The 8.6% was a new high for this cycle. The core inflation also came higher than expected. This would be highest it has been in 40 years. What would make it worse is - if we measured the CPI the way it was measured 40 years ago, the number now, would be well more than 15% already. That number would have taken out the historical high of 13% of the late 1970s.

Gas prices hitting $5/gallon across all US cities this weekend confirmed the pain at the pump.

The university of Michigan consumer confidence sentiment number came out and it came in around 50 - the worst in its 70-year history. Consumers think this month is the worse month than anytime in the past including the 1970s peak oil crisis, 1980s inflation, 1987 black Monday event, 2000s dotcom crash, the 2008 great financial crisis and the covid pandemic from last year.

The S&P 500, the thermometer of the US economy, had its worst start to the year in a 100 years. The bond market arguably had its worst start to the year in 200 years. Inflation possibly at an all time high - things look lot bleaker. Only thing that is going good is the fact that Americans are able to cling to their jobs with unemployment at a low at 3.6%. The jobs market will reflect the economic reality in the 3rd and 4th quarter of 2022. The huge lay-offs are coming. Unemployment is a lagging economic indicator always and the carnage is just ahead of us.

President Biden, this week had the courage to say - the American people are capable enough to meet the rising prices head-on because the labor market is good. A true admission would be to acknowledge the past mistakes of fiscal & deficit budget policy since the global financial crisis of which he was very much part as Vice-President in the Obama administration. With the job market beginning to show cracks (the initial jobless claims from last week coming in 20% more than expected. We might have seen the bottom there already).

Inflation - is the most misunderstood concept globally. Milton Friedman said - Inflation is always and everywhere a monetary phenomenon. Expanding money supply causes inflation. Inflation is the expansion of the money supply and price increases, are consequences of it. In other words - if more money is printed and are in circulation, the prices of available products will go high. Printing the money is the easy part, producing the consumer products is the difficult part.

Price increases affects everyone in the society. When i say price increase - i mean price increase of "everything". In the modern way of financial capitalism, we have been made to think, prices of food/fuel/utilities going up are bad and prices of stocks/homes/wages going up are good. why should that be? When you purchase a home and the price of the home goes high - people feel happy. When you purchase stocks and the price of the stock goes many folds - people feel happy. When the stock market indexes go higher and higher - people and business feel happy about it. What they don't say you - this too is inflation and it is bad for the economy. Only when the price of food, fuel and all consumer prices goes high - it is considered bad which is pretty unfair.

In reality stocks of good performing companies can go high as they add value. but all stocks going high is a problem. Wages or Salary is just the price of labor. When my salary goes high at work because I'm more productive compared to others - then its a good thing. If everyone's salary goes high in equal percentage amount - what difference does it make? when workers productivity goes up (enhanced skills, mechanization and automation) - cost of production becomes cheaper. In an society with productive labor - prices of commodities fall.

With the price of stocks/bonds/homes increasing multi folds in the last decade, the inflation was ALWAYS there. It just started to show up in the CPI components. I really think - CPI data must include speculative and risky assets like stocks/bonds/wages as it components. It must also include home prices, not rents (which get manipulated by owners' equivalent rent - which no one pays!). That would be a more accurate of consumer prices. The case-shriller index that measures the price of homes came in last week - home increased in value by a whopping 21% across the top major cities. What would be the CPI print, if they add this? no wonder they don't add this number to the CPI.

Below is the yield on the US bonds as of this weekend.

Why would anyone buy the US 2 year for a 3.06% coupon, when the official yearly inflation is 8.6%? If you buy the bond today - you are guaranteed to lose money (~5.5%) when you get your principal back in 2 years in lesser valued dollars. Why would anyone (looking to profit) will buy the US 30 year for a 3.2% coupon is beyond human intelligence. The average inflation for 30 years must be around 2% is what the buyer is thinking., so that he can benefit 1% from it. Say if the inflation stays 4% for few years, to average it out - it needs to be sub 0% for few years to maintain the 2% average. The probability of this happening is almost 0. In a real free market, these conditions will not exist. Also on the numbers, you can see the 3Y inverting with the 30Y (called the inversion of yield curve) signalling something is broken already or something is about to break.The fall in the stock market has a long way to go and the odds of a flash crash is very much possible.

There is definitely a huge difference between people parking their hard-earned savings in US bonds and the Central banks buying in the open market what was originally theirs anyway.

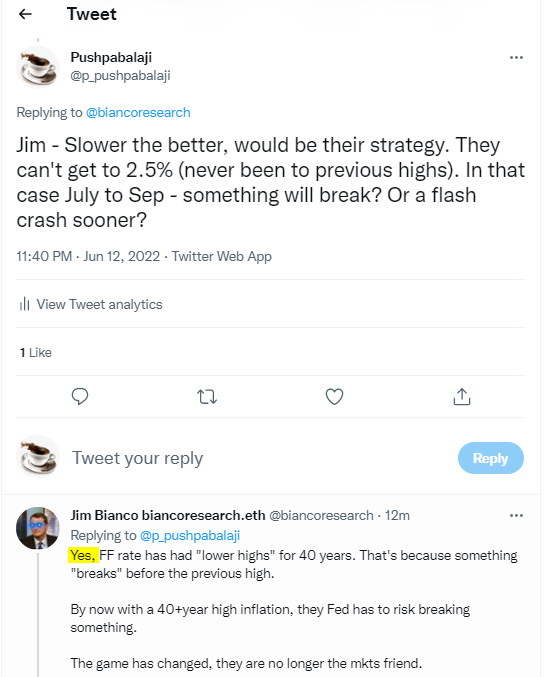

With inflation getting hotter and hotter, the US Central bank has to raise rate. They will do a 0.5% this week. What good does a 1.25% rate do to a 8.6% inflation? Nothing! They can't go to 2.5% is what i think (Jim Bianco agrees with me! - see image)

What I think, they will end up doing is - they will raise the interest rate high enough to cause the recession (most likely depression), but not high enough to solve the inflation. A higher interest rate than the inflation rate would be the right thing to do - it would just blow up the entire global financial markets within hours. (if doing the right thing causes more pain - then you know its all messed up disproportionately)

The recession will cause the job losses. A lot of them! The looming layoffs on the horizon is not a hurricane but the hurricane. Imagine having a beach ball in hand and holding it above your head. it is hard to convince someone, that you will take the hand out and the ball will not fall. It has to & will fall.

The tech stocks & the cryptos have taken a hit already. The coming lay-offs are going to be huge and unprecedented. Because the boom from last decade was unprecedented, the bust has to be proportionally bigger. The tech sector will be annihilated similar to the dotcom crash of 2000. What we have there is a massive bubble. The air has already come out of it. It's just a matter of time (weeks), reality catches up. The industry is just unsustainable in its current proportion. It needs to be lot leaner. Tech-oriented Nasdaq chart is below (see image). The circled portion is what was the 2000 dotcom crash. If that kind of fall from 5000 points to 700 caused so much pain, imagine the fall from 16300. You can see from the chart image - the slide has started and its just accelerating. Almost all tech stocks are down 30% or more this year, including the big names like FAANG (Netflix is down 70%, Amazon is down 35% from their highs from November). When valuations are hit this much, the tech employment has to take a hit too. Believe me - this is just getting started and it will get very worse very soon.

The great financial crisis of 2008 was essentially a US housing problem. I am a living eye-witness to that mess and so are many who owned a house during the spectacular boom and the eventual bursting of home prices in late 2007 and into 2008. Prices of home crashed, in some cases more than 50% and every bank which loans money to home owners failed. The government had to rescue the entire housing market and ALL the banks. The entire episode can repeat again. I think it will repeat in a even more worse way for the following reasons: (unlike last time) People well remember fresh in their mind, the loss on investment on housing in 2008 did. Once they know, the house price is starting to fall, everyone might head to the exit exacerbating the problem further. More houses will be put for sale and no takers. The word of smoke can create a stampede at the doors. If you think the high prices of 2007 caused the housing collapse, its even higher now. The mortgage prices have gone from its low of sub-3% to close to 6% now. Even though the 6% is less than historical normal, with the prices at sky-high, its lot of expense for the new home owner. When people start losing jobs and cannot afford to pay the mortgage or have to relocate to take another job somewhere else - and want to sell their homes, it will cause a housing crisis of at least the same magnitude. If you are not convinced yet the housing crisis is on the horizon - look at the mortgage application data from last month. It was down 22% and this is a 22 year high. And then you realize that this period includes the housing bust of 2007. Let that sink in.

Even though it will be unfortunate and painful for people to lose their jobs, in the long term - this is exactly what we want. Particularly in technology, people are over paid and a lot of jobs are not "impact full jobs". Scarce human resources are seriously miss-allocated. Instead of being fearful of the recession, we need to embrace it. The mal-investments of the last decade needs to fixed. The market has to do that. Failure to rectify this at this point, will make it far worse in the future causing even bigger pains.